150 years - Embracing Innovation

In our 150 years we have known one certainty: life is always changing. And so are we.

Create a will online

In our 150 years we have known one certainty:

life is always changing.

And so are we.

Through embracing new technology, products and services, Public Trust has a proud legacy of adapting and modernising to meet the needs of New Zealanders.

The Age of Mechanisation (1919)

At the end of the First World War, Public Trust was overhauled during the short but significant tenure of Public Trustee Robert Triggs – the architect of the organisation’s decentralisation and mechanisation.

In 1919, Robert Triggs (Public Trustee, 1917-1920) began the decentralisation of Public Trust from a single head office to multiple district offices in order to get closer to its customers. District Public Trustees would be held in high-standing in their communities during the 20th Century.

Triggs also introduced mechanised accounting methods to increase efficiency with the first US ledger posting machines installed at head office and the main centres in 1919. These machines were kept busy as Public Trust doubled its number of wills to 53,000 between 1919 and 1927, and posted a record profit of £90,522 in 1925. Branches and staff grew, and a Public Trust building boom followed – it was certainly the ‘Roaring Twenties’ for Public Trust.

The Computer Age (1967)

In 1967, the year that New Zealand converted from pounds sterling to decimal currency, Public Trust entered the computer age.

Electronic Data Processing (EDP) for all estates, funds and investments was up and running by early 1967. The conversion came at a high cost but its value to the business was soon realised, revealing Public Trust as an early adopter of computers.

And this digital innovation continued.

When technology was rapidly changing during the 1990s, Public Trust was one of the first major organisations to install Microsoft Windows 95 and Microsoft Office in 1996, including email, supporting each staff member to have a desktop computer networked on the LAN – or ‘local area network’. This digital enablement increased productivity and was viewed as the key to business growth. By the end of the decade, Public Trust was once again one of the first organisations to implement Microsoft Office 2000 and a Document Management System. Workflow technology – computerising transactions processes – supported the work of estate managers to help all New Zealanders.

Corporate Trustee Services (1967)

Public Trust has been providing corporate trustee services to a wide range of public and private schemes since 1967, and is retained by many of New Zealand's most respected financial services and investment companies.

The strengths of Public Trust's Corporate Trustee Services is its established roots, reputation and depth of experience. Public Trust has been the first choice for many New Zealand corporate businesses and has helped maintain consumer and investor trust in the financial system.

Corporate Trustee Services is licensed under the Financial Markets Supervisors Act 2011 and, in FY22, had supervisory and/or custodial oversight of $168bn of managed funds, $32.7bn of which was for KiwiSaver. During the same period, Public Trust supervised 14 of New Zealand’s KiwiSaver schemes, including four of the six default KiwiSaver schemes.

Public Trust's Corporate Trustee Services are underpinned by an important ethos about advocating for and acting in the best interest of Kiwi investors – big and small. Protecting Kiwi legacies is what Corporate Trustee Services does on a daily basis.

Plain English Wills (1986)

The Public Trust’s award-winning Plain English Campaign came about to meet the needs of our customers.

The Public Trust’s Plain English Wills campaign in 1986 was the result of its first comprehensive market research, which revealed that customers preferred documents and communications written in language that was readily understood.

The success of the Plain English Campaign was recognised with the inaugural Plain English Award presented by the New Zealand Plain English Campaign.

Today, a core value at Public Trust is making tricky topics like death, money and the future simpler to navigate.

Public Trust builds trust by always being clear in what it says and upfront about how actions taken today will affect the future.

Online Wills (2002)

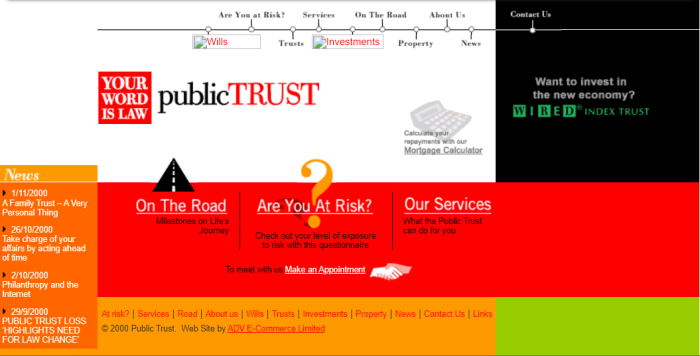

Public Trust entered the digital highway early with the launch of its first website publictrust.co.nz in 2000.

With the launch of a new technology platform in 2016 Public Trust became a technology leader in the trustee services industry, able to fully embrace the digital future and provide customers with more choice in how they can interact with us.

In 2020, in the midst of New Zealand’s first Covid-19 lockdown, Public Trust launched its new online platform for wills and enduring powers of attorney.

The new digital platform and shift in how Public Trust engaged with its customers to fully virtual was tested during the Covid-19 lockdowns when it was able to stay connected with and respond to New Zealanders during this most challenging time.

Student Fee Protect (2003)

In 2003, the government responded to the failure of a number of Private Training Establishments (PTE) by requiring all student fees to be held in trust and paid to training providers in instalments rather than as a lump sum. As a result, Public Trust developed a trust scheme, Fee Protect, for the protection of the course fees and other expenses paid in advance by a large number of mainly international students.

Fee Protect, developed in conjunction with the New Zealand Qualifications Authority (NZQA) and a number of PTEs, protects students from losses outside of their control (for example, due to closure or insolvency of a course provider), and helped create greater confidence in New Zealand as an education destination. Fee Protect has safeguarded hundreds of thousands of students since its inception.

Today, Public Trust safeguards fees on behalf of over 200 PTEs through Fee Protect.

Our Digital Future

Today, Public Trust is embracing our digital future.

A seamless digital experience, offering more options for customers in how they plan and manage their life planning documents, is critical in this rapidly moving digital environment. With self-service tools that are easy to use, Public Trust already offers a personalised experience, and will continue to broaden the reach of its digital services.

It is the latest example of a history of Public Trust embracing innovation to help New Zealanders to build and protect their legacies.